South Carolina Estate Tax Exemption 2025. Who is subjected to an estate tax in 2025? What’s the difference between inheritance tax and estate tax?

Larger estates will take longer to “settle,” or pass off to beneficiaries. Introduced in the house on march 13, 2025 ways and means.

South Carolina Hotel Tax Exempt Form, How to legally avoid the south carolina estate tax. However, the exemption is set to return to $5,000,000 (adjusted for inflation) as of january 1, 2026, so tax planning is still prudent for families that may be affected by the 2026 adjustment.

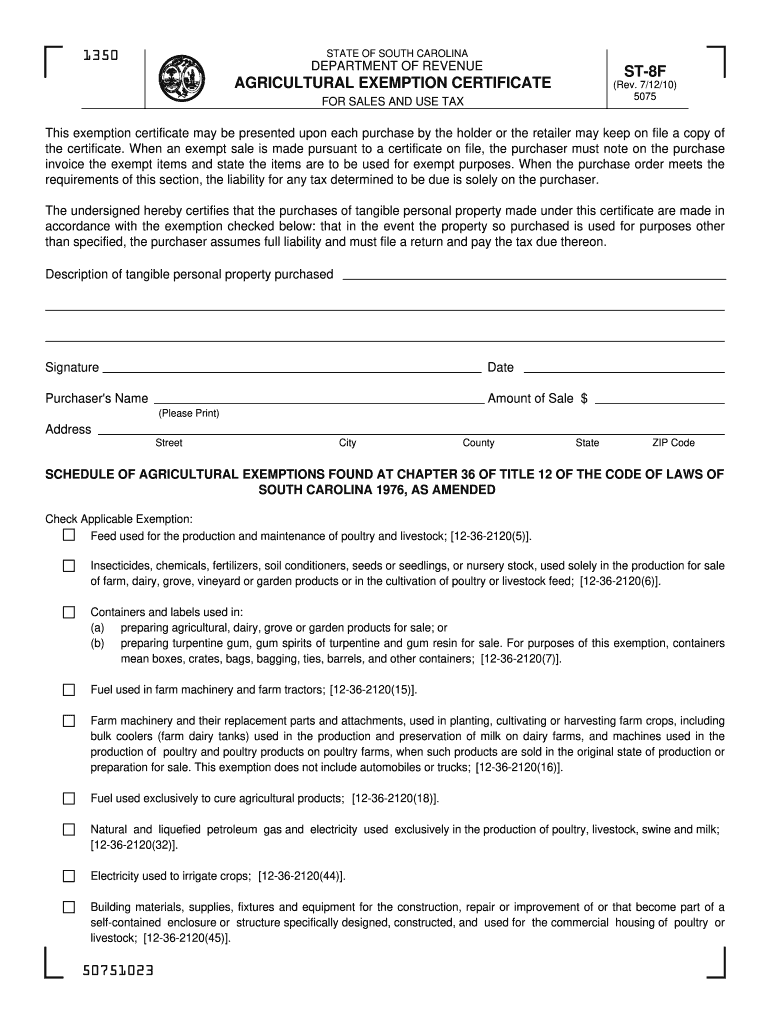

South Carolina Agricultural Exemption 20102024 Form Fill Out and, Without congressional intervention, these tax breaks will continue to be in effect (with annual adjustments for inflation) until 2026. View the latest legislative information at the website.

proposed federal estate tax changes 2025 Mariann Kaplan, A higher exemption means more estates may be exempt from the federal tax this year, which. Introduced in the house on march 13, 2025 ways and means.

Marge Colson, South carolina is looking to pass a rebate that would send $1.8 billion back to taxpayers. Estate taxes vary depending on the size of the decedent’s estate.

Estate Tax Exemption Changes Coming in 2026 Estate Planning, It has a progressive scale of up to 40%. The federal estate tax exemption is $13.61 million in 2025, up from $12.92 million in 2025.

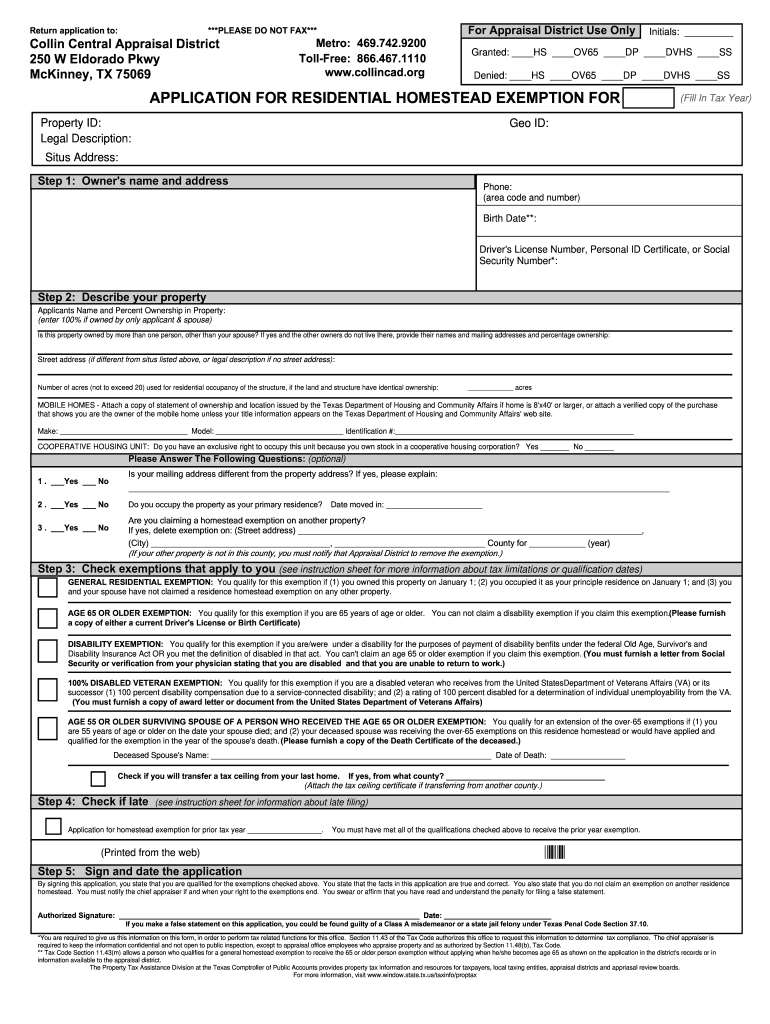

14+ Waller County Homestead Exemption MhairiRhylie, The exterior of the south carolina state house is seen on january 29, 2025, in columbia, south carolina. Large estates that exceed a lifetime exemption of $12,06 million are subject to the federal estate tax.

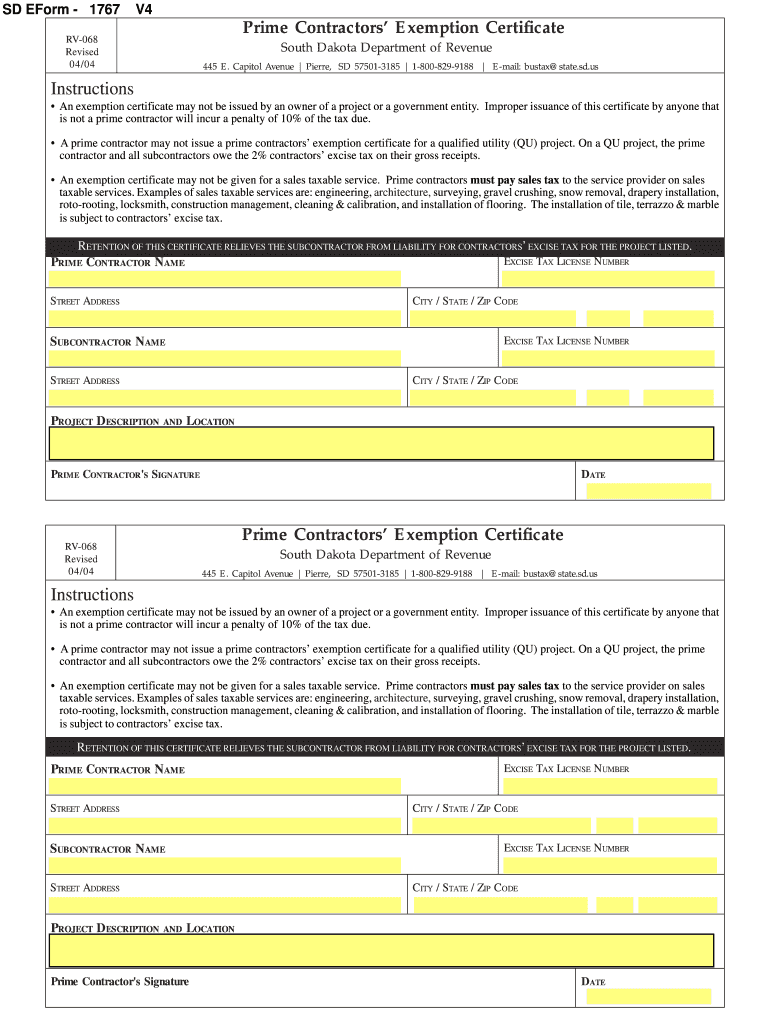

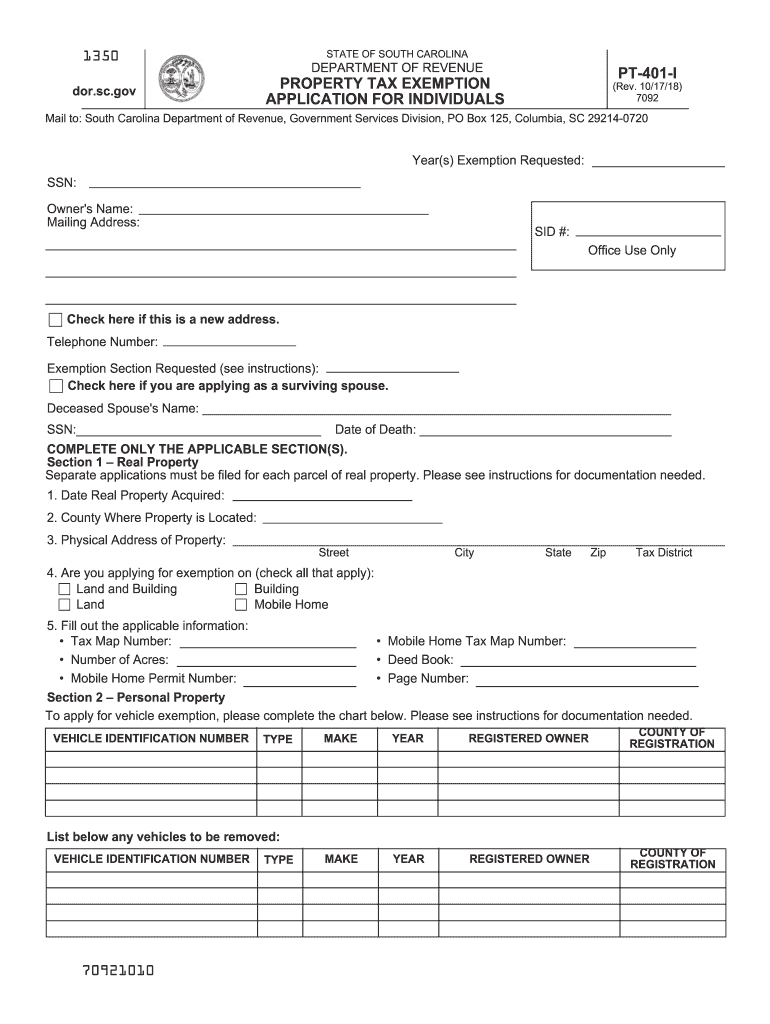

South Dakota Exemption Certificate Form Fill Out and Sign Printable, Filing deadline in south carolina is march 15, 2025. How to handle estate taxes.

3 Tips for a Paying a Low South Carolina Estate Tax, South carolina is looking to pass a rebate that would send $1.8 billion back to taxpayers. Through the south carolina department of revenue's online services.

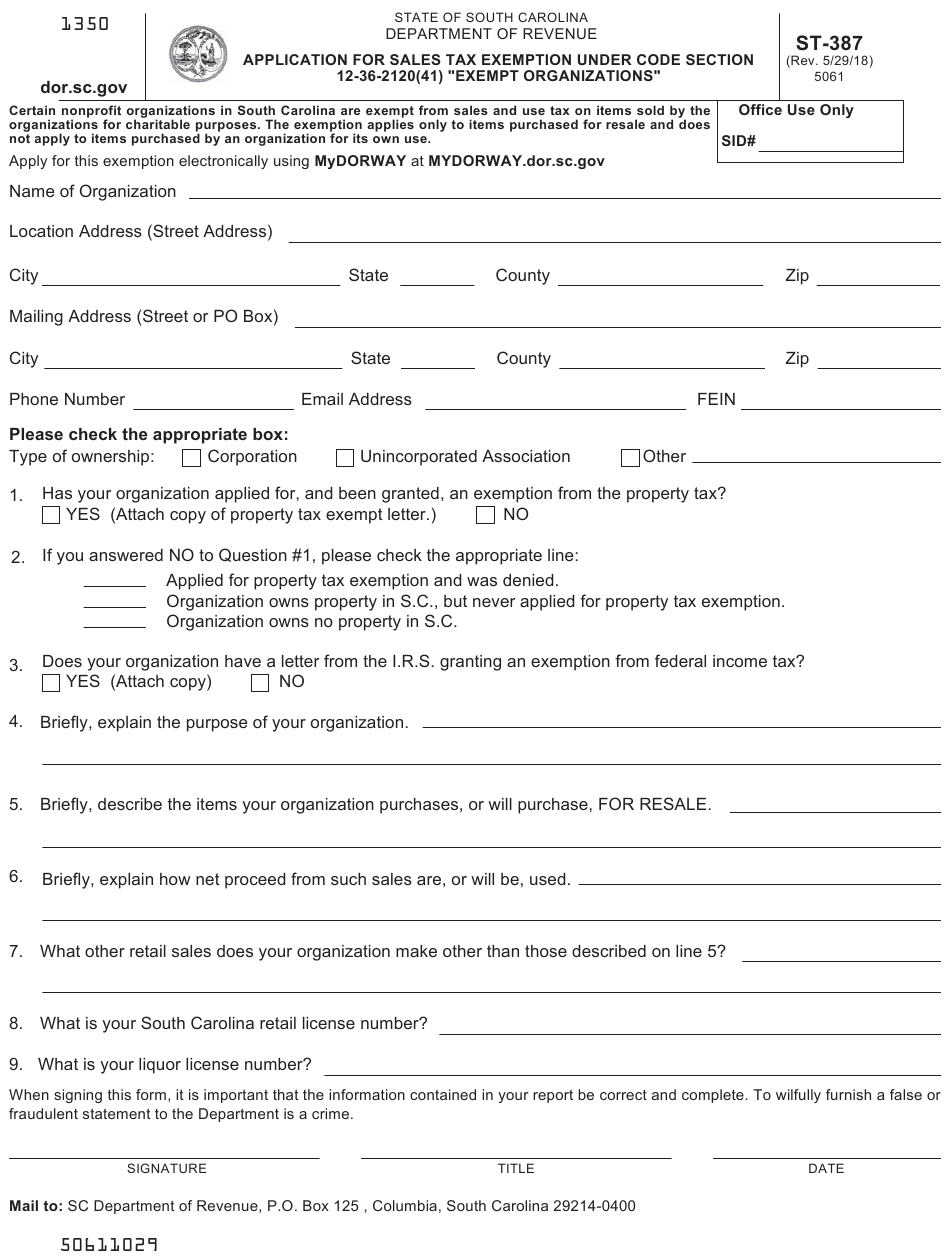

South Carolina State Sales Tax Exemption Form, Through the south carolina department of revenue's online services. For a married couple, the exemption is $24,120,000.

Bupa Tax Exemption Form How Much Savings Is My Texas Homestead, Today we are covering sales tax developments in alabama, colorado, south carolina and arkansas, a franchise tax development from tennessee, and corporate. Be it enacted by the general assembly of the state of south carolina:

The federal estate tax exemption was $12.92 million for deaths in 2025 and goes up to $13.61 million for deaths in 2025.

Rna Leaders 2025. Uncover emerging rna modalities and applications such as circular rnas, dark genome, rna editing, diagnostics, rna editing...

Ghosts Uk 2025. Ghosts uk season 2 episode 6 review: Ghosts uk will wrap up with season 5, while ghosts...

Bryan Abreu 2025. View the 2025 mlb season full splits for bryan abreu of the houston astros on espn. Bryan...

Will There Be Market Crash In 2025. New data reveals a crash not seen since great depression could hit in...

Real Funny Jokes 2025. Don’t copy those (97,619) floppies. You might get stuck in the apple. Why did the woman...

Wedding In March 2025. For those who prefer the idea of a weekend wedding, we have especially good news: From...