Irs Per Diem Rates 2025 Meals. Per diem rates 2025 philippines. General services administration (gsa) released the fiscal year 2025 continental united states (conus) per diem.

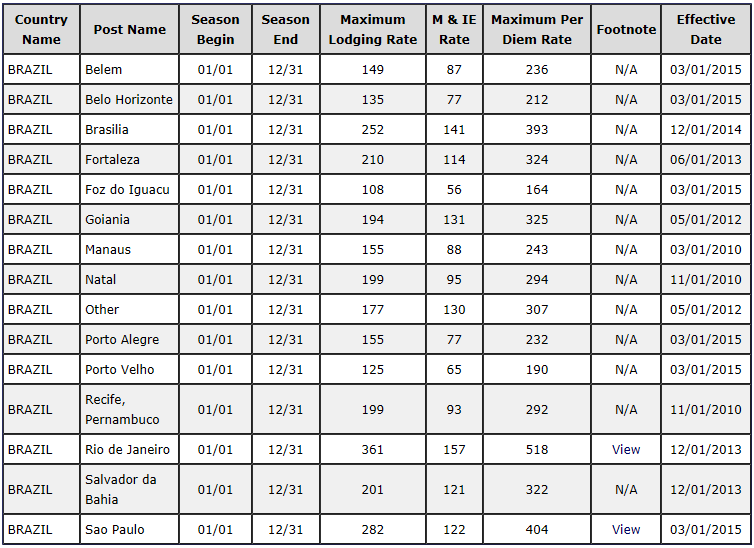

The irs makes it easy for business travelers by allowing the use of “per diem” rates, which are daily allowances to compensate for lodging, meals and incidental. For 2025, the mileage rate is $0.655 per.

Irs Food Per Diem 2025 Mair Sophie, Per diem rates rates are set by fiscal year, effective oct. Per diem rates 2025 philippines.

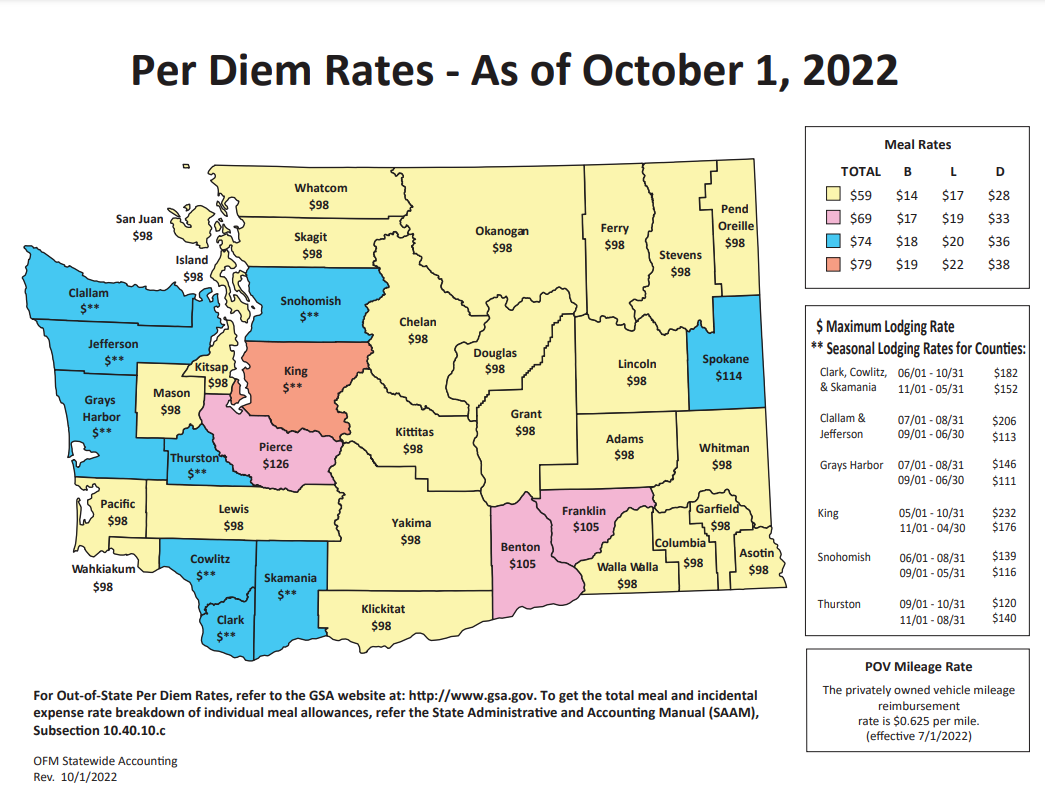

Irs Per Diem Rates 2025 Meals Audre Doralynne, Washington — today, the u.s. Meals & incidentals (m&ie) rates and breakdown.

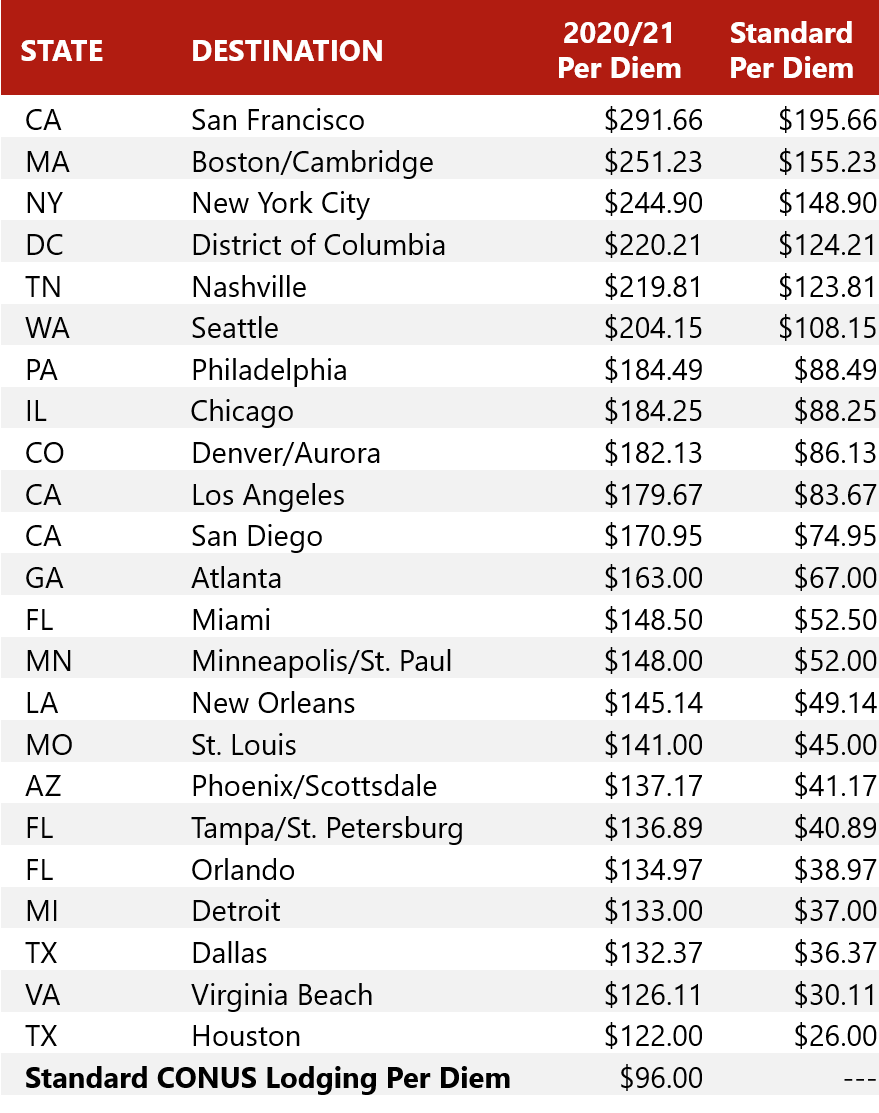

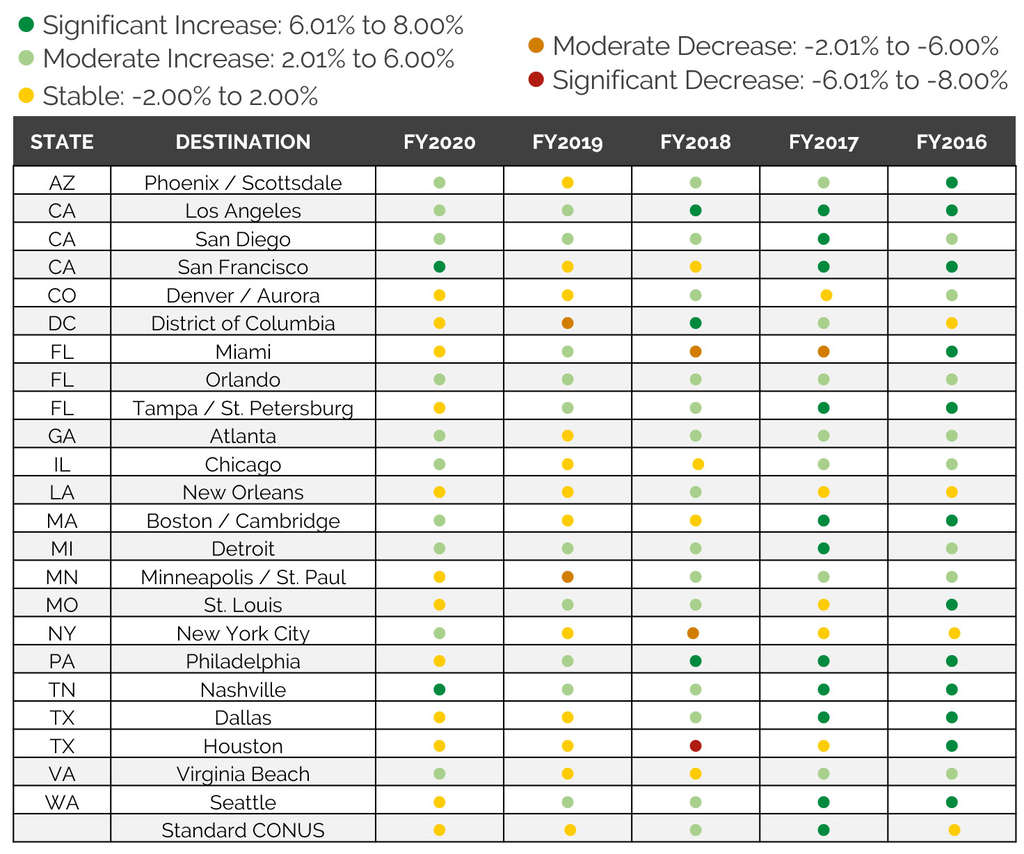

HVS Federal Per Diem Fiscal 2025/21 & Historical Trends, Optional special per diem rates. These updated rates include changes for the.

Irs Per Diem Rates 2025 Meals Lynne Rosalie, You can choose to use the rates from the 2025 fiscal year per diem. These updated rates include changes for the.

Per Diem Rates Current & Historical Trends By Chelsey Leffet, Optional special per diem rates. General services administration (gsa) released the fiscal year 2025 continental united states (conus) per diem.

Federal Government Per Diem Rates 2025 Alana Augusta, Per diem rates 2025 philippines. Use this table to find the following information for federal employee travel:

IRS provides guidance on per diem rates and the temporary 100, New per diem rates were recently announced by the irs and are effective for per diem allowances on or after oct. Meals & incidentals (m&ie) rates and breakdown.

What Is Per Diem? Definition, Types of Expenses, & 2025 Rates, The philippines, much like the rest. Taxpayers can use the special per diem rates to substantiate the amount of expenses for lodging,.

IRS to allow higher per diem for meal expenses for ownerops starting, Per diem rates are listed by the federal government's fiscal year, which runs from october 1 to september 30. Washington — today, the u.s.

PPT A Travel Reimbursement From Start To Finish PowerPoint, For 2025, the mileage rate is $0.655 per. Meals & incidentals (m&ie) rates and breakdown.